1099 Form Michigan Printable

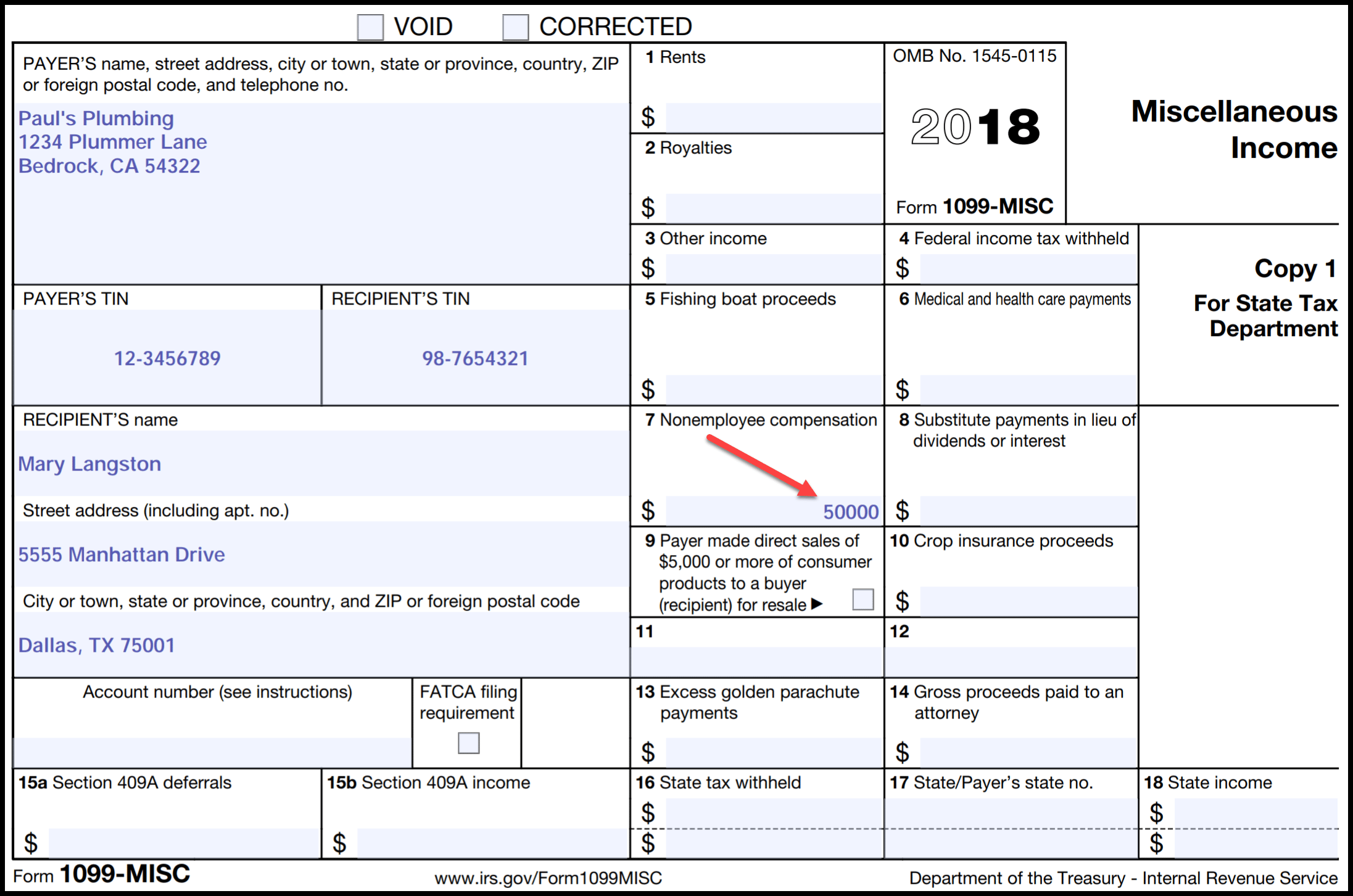

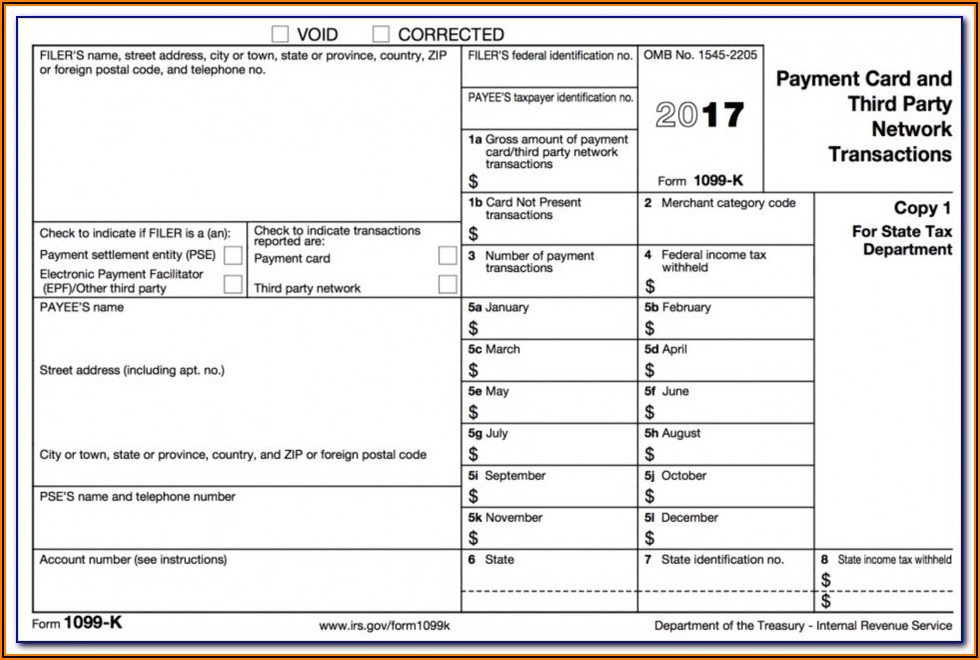

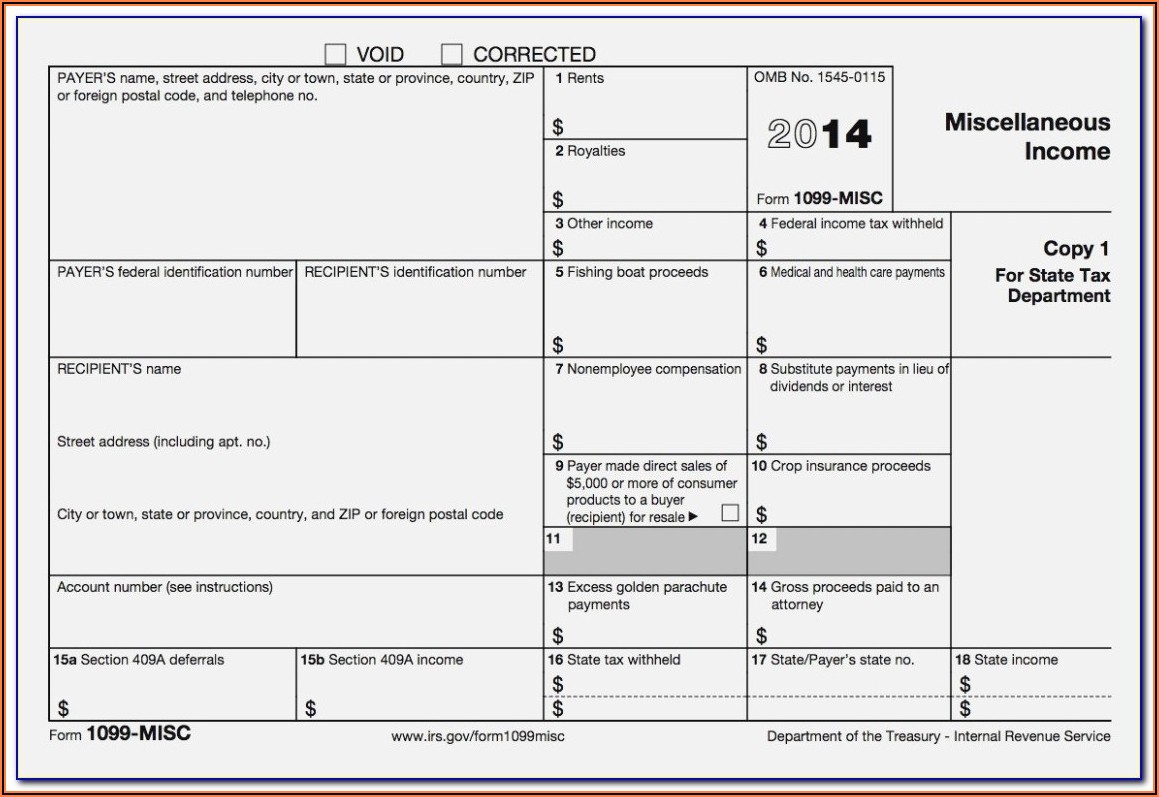

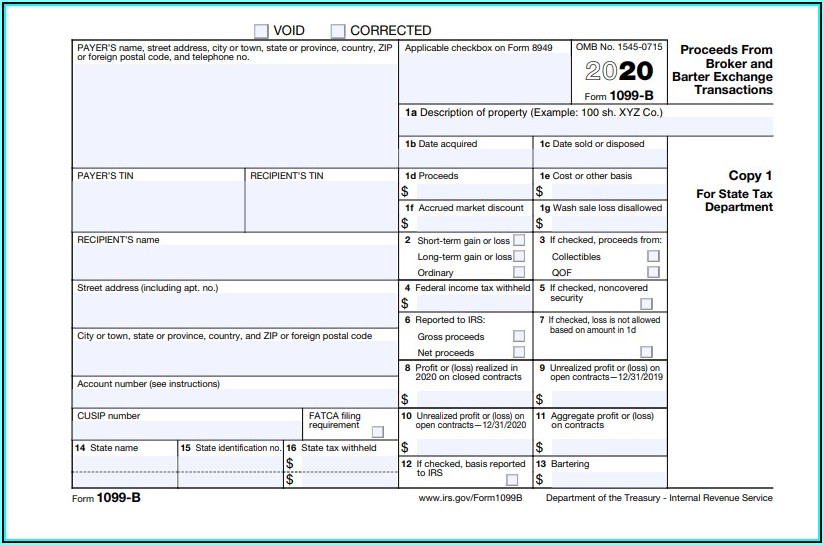

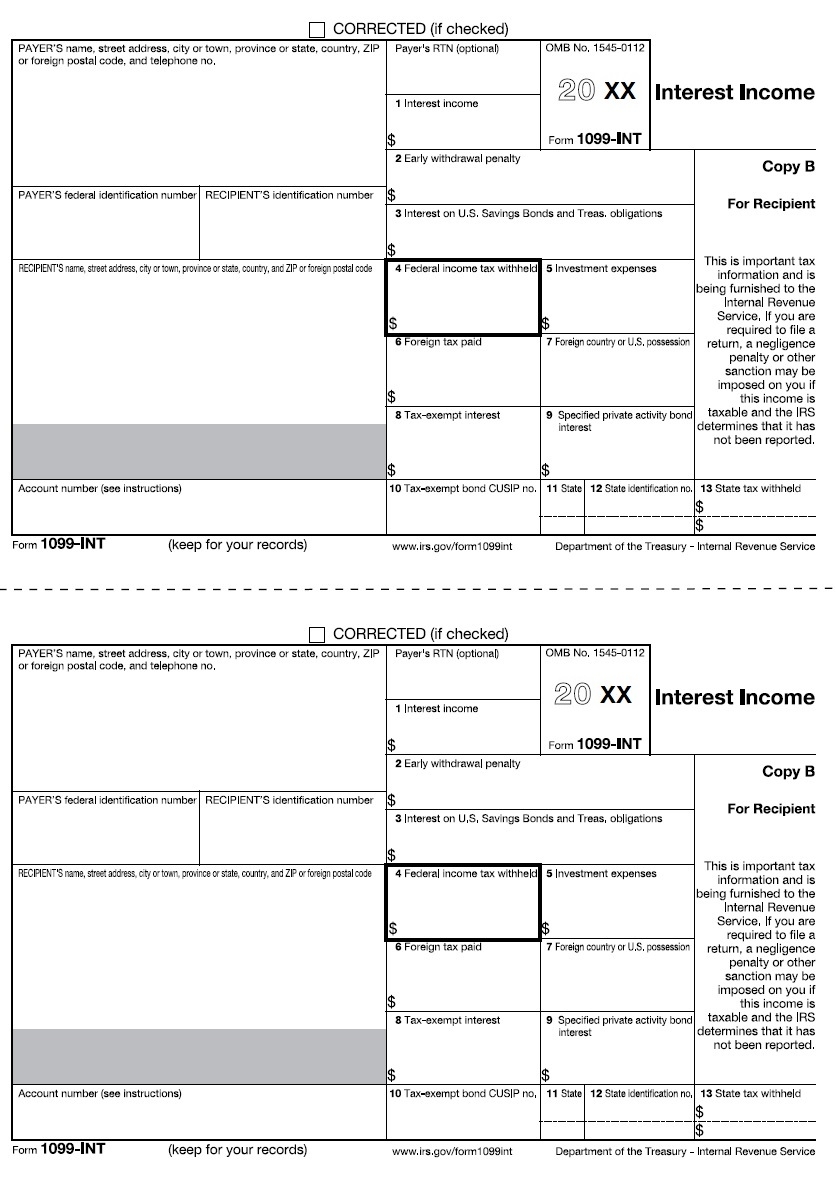

1099 Form Michigan Printable - Instructions for michigan vehicle dealers collecting sales tax from buyers who will register and title their vehicle in another state or country: Paper copies of income statements from issuers with fewer than 250 statements may be mailed to the following address: Sales and other dispositions of capital assets: Sales, use and withholding tax due dates for holidays and weekends: Employee's michigan withholding exemption certificate and instructions: Which section of form 4884 should i complete? Taxable income from any 1099 forms from which michigan tax was withheld. Sales, use and withholding tax due dates for holidays and weekends: Michigan sales and use tax certificate of exemption: Looking for forms from 2017 and earlier? Michigan sales and use tax certificate of exemption: Looking for forms from 2017 and earlier? Instructions for payments of michigan sales, use, withholding, and other michigan business taxes using electronic funds transfer (eft) credit: Paper copies of income statements from issuers with fewer than 250 statements may be mailed to the following address: Which section of form 4884 should i complete? The irs determines the type of federal form required and the state of michigan follows these federal guidelines. Instructions for michigan vehicle dealers collecting sales tax from buyers who will register and title their vehicle in another state or country: Employee's michigan withholding exemption certificate and instructions: Enter total of line 4 from table 1 and line 5 from table 2. Sales tax return for special events: Instructions for payments of michigan sales, use, withholding, and other michigan business taxes using electronic funds transfer (eft) credit: Instructions for michigan vehicle dealers collecting sales tax from buyers who will register and title their vehicle in another state or country: Enter total of line 4 from table 1 and line 5 from table 2. Sales and other dispositions of. Enter total of line 4 from table 1 and line 5 from table 2. Sales tax return for special events: Notice of change or discontinuance: Sales, use and withholding tax due dates for holidays and weekends: Michigan sales and use tax certificate of exemption: Sales and other dispositions of capital assets: Enter total of line 4 from table 1 and line 5 from table 2. Sales, use, and withholding taxes annual return (form 5081) is due march 1, 2021. Which section of form 4884 should i complete? Withholding certificate for michigan pension or annuity payments: Michigan department of treasury lansing, mi 48930. Looking for forms from 2017 and earlier? Michigan sales and use tax certificate of exemption: Which section of form 4884 should i complete? Sales, use and withholding tax due dates for holidays and weekends: Instructions for michigan vehicle dealers collecting sales tax from buyers who will register and title their vehicle in another state or country: Notice of change or discontinuance: Michigan department of treasury lansing, mi 48930. Retirement benefits from a deceased spouse. Taxable income from any 1099 forms from which michigan tax was withheld. Sales, use and withholding tax due dates for holidays and weekends: Sales tax return for special events: Taxable income from any 1099 forms from which michigan tax was withheld. Paper copies of income statements from issuers with fewer than 250 statements may be mailed to the following address: Instructions for michigan vehicle dealers collecting sales tax from buyers who will. Michigan department of treasury lansing, mi 48930. Instructions for payments of michigan sales, use, withholding, and other michigan business taxes using electronic funds transfer (eft) credit: Employee's michigan withholding exemption certificate and instructions: Sales and other dispositions of capital assets: Looking for forms from 2017 and earlier? Looking for forms from 2017 and earlier? Michigan department of treasury lansing, mi 48930. Retirement benefits from a deceased spouse. Sales tax return for special events: Which section of form 4884 should i complete? Sales, use, and withholding taxes annual return (form 5081) is due march 1, 2021. Notice of change or discontinuance: Paper copies of income statements from issuers with fewer than 250 statements may be mailed to the following address: Enter total of line 4 from table 1 and line 5 from table 2. Which section of form 4884 should i complete? Instructions for michigan vehicle dealers collecting sales tax from buyers who will register and title their vehicle in another state or country: Sales and other dispositions of capital assets: Retirement benefits from a deceased spouse. Michigan department of treasury lansing, mi 48930. Instructions for payments of michigan sales, use, withholding, and other michigan business taxes using electronic funds transfer (eft). The irs determines the type of federal form required and the state of michigan follows these federal guidelines. Which section of form 4884 should i complete? Notice of change or discontinuance: Employee's michigan withholding exemption certificate and instructions: Michigan sales and use tax certificate of exemption: Enter total of line 4 from table 1 and line 5 from table 2. Instructions for michigan vehicle dealers collecting sales tax from buyers who will register and title their vehicle in another state or country: Sales, use and withholding tax due dates for holidays and weekends: Michigan department of treasury lansing, mi 48930. Paper copies of income statements from issuers with fewer than 250 statements may be mailed to the following address: Looking for forms from 2017 and earlier? Sales tax return for special events: Withholding certificate for michigan pension or annuity payments: Instructions for payments of michigan sales, use, withholding, and other michigan business taxes using electronic funds transfer (eft) credit: Taxable income from any 1099 forms from which michigan tax was withheld.1099 Form Michigan Printable Printable Forms Free Online

1099 Form Michigan Printable

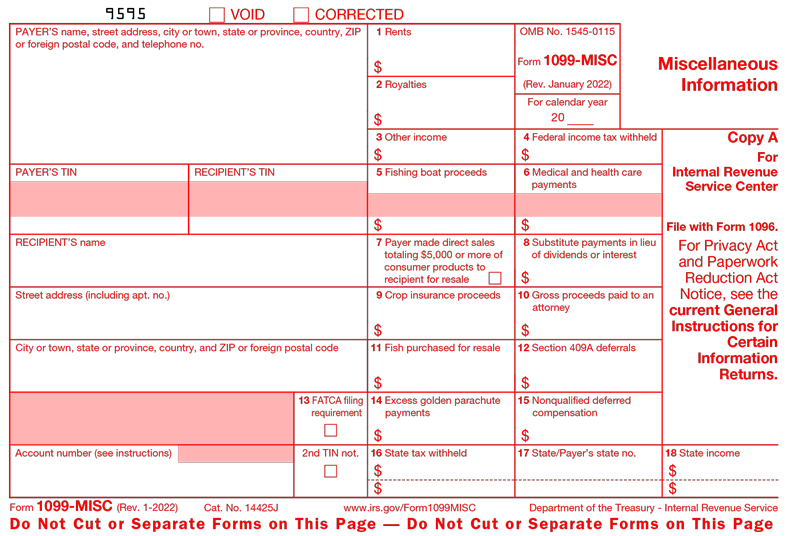

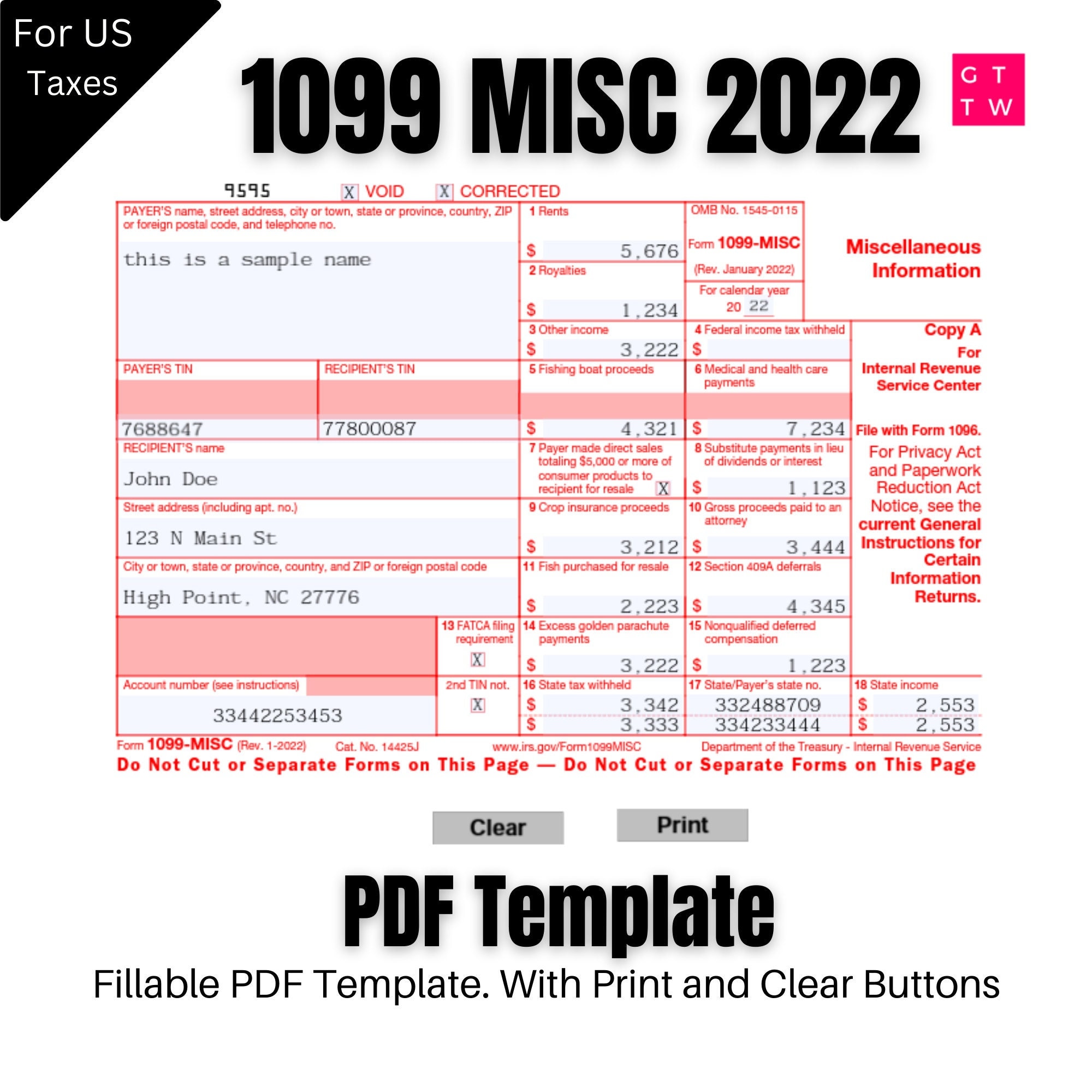

2020 Form 1099MISC Create Fillable & Printable 1099MISC for Free

1099 Form Michigan Printable

1099 Printable Forms

1099 Form Michigan Printable Form Resume Examples Wk9y6oO7Y3

Michigan Form 1099 R Form Resume Examples P32E5g8r2J

1099 Form Michigan Printable Printable Forms Free Online

1099INT Recipient Copy B

Irs Printable 1099 Misc Form Printable Forms Free Online

Retirement Benefits From A Deceased Spouse.

Sales, Use And Withholding Tax Due Dates For Holidays And Weekends:

Sales, Use, And Withholding Taxes Annual Return (Form 5081) Is Due March 1, 2021.

Sales And Other Dispositions Of Capital Assets:

Related Post: